When it comes to matters of finance and trading, geographical location matters as much as knowledge and expertise. In the past decade, Asia has been a major player in the market, with China and India taking up the starring roles.

But not all Asian cities are equal. Regulations, local politics, existing (or the lack of) trade agreements, may prevent serious traders from maximising their potentials.

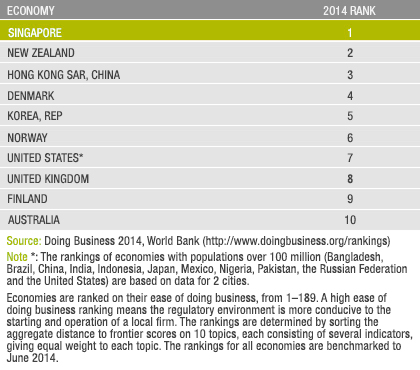

Which is why Singapore makes the perfect choice to set up shop. To cite a few accolades, according to a 2014 World Bank “Doing Business Report”1, Singapore ranked first as the world’s easiest place to do business, citing the ease of setting up a company and handling administrative matters.

In addition, in its BERI Report 2014-I (April 2014)2, US-based research institute Business Environment Risk Intelligence (BERI) ranked Singapore first out of 50 major investment destinations in a ranking that assesses operations, politics and foreign exchange. With no restrictions on the repatriation of profits and the import of capital, along with the most favourable operating conditions and strong diplomatic ties, Singapore’s stable political and economic climate creates an ideal environment to invest in.

New businesses set up in Singapore further enjoy attractive incentives in the form of Taxation Incentives (reduced corporate tax rates, and even tax exemptions); Capital Grants (funding, allowances, waivers and reliefs); and Technology Development Grants (specifically for R & D and tech-related businesses).

Singapore is also the most transparent country in Asia3, the result of decades-long political stability, a fair economic climate, and clear government policies. The Singapore government is also firm in establishing an efficient and transparent legal and judicial framework, thus providing a favourable regulatory and business environment with a high degree of banking confidentiality.

With such a reputation, it’s no wonder that Singapore has a robust trade ecosystem. Traders in the Lion City enjoy access to low-cost trade financing in a highly-evolved banking and financial infrastructure that is ranked among the Top 5 foreign exchange centres in the world, enabling firms to hedge foreign exchange exposure easily.

Furthermore, Singapore-based insurers and insurance brokers are increasingly offering specialised lines for complex risks, such as aviation, energy, marine, political and trade credit risks.

Global assets under management (AUM) rose to $62.4 trillion in 2012, according to Boston Consulting Group4. Singapore has a reported US$1.8 trillion in AUM and lays claim to be the largest institutional investor base in Asia2.

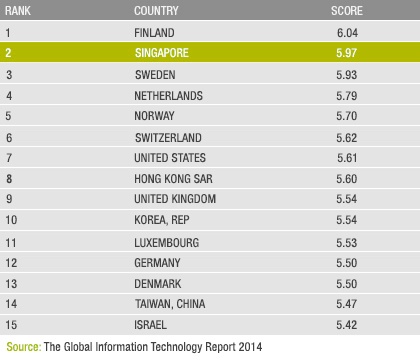

Coupled with a global network of secured data centres linked by connections that boast one of the world’s lowest latency and Asia’s most network-ready country6, all this activity has resulted in a high average turnover in foreign exchange markets, amounting to USD 266 billion, or 5.3% of worldwide total. [Source: Data as of April 2010 by Bank for International Settlements (BIS)]

Singapore’s advantageous geographical location has also allowed it to be one of the world’s freest economy, with an impressive list of trade agreements with neighbouring countries in the region and further. To date, there are 75 Double Taxation Agreements (DTA), 41 Investment Guarantee Agreements (IGA), and 20 Free Trade Agreements (FTA) and Economic Partnership Agreements.

All this clearly adds up in Singapore’s favour, setting the stage for it to become the top choice for Asian expatriates in the past 12 years. This influx of trading talents has created a large pool of experienced traders in Singapore, the largest in the world after London, New York and Houston, with the added plus of being fluent in English, Bahasa and Chinese.

How Can We Help?

Neo & Partners Global can help you tap into this growing community of trading specialists. We can facilitate the incorporation of your business into this vibrant city. With our network of legal and secretariat service providers, combined with local regulatory knowledge, you can expect a smooth and effortless experience. After all, the only answer to the question “Why Singapore?” should be a firm “Why not?”

References:

(1) The World's Easiest Place to Do Business |

(2) Economic Performance - No. 1 City with the Best Investment Potential |

(3) Government - Most Transparent Country in Asia  |

| (4) Asset management hits record level, David Oakley, Financial Times, July 9, 2013. |

| (5) Building the Trading Systems of Tomorrow, Bob Caisley, CIO, SGX. Singapore’s 2nd Annual Technology & Innovation Conference, October 12, 2011. |

(6) Competitiveness & Business Environment - The world’s easiest place to do business and Asia’s most network-ready country

|